36+ Joint mortgage how much can i borrow

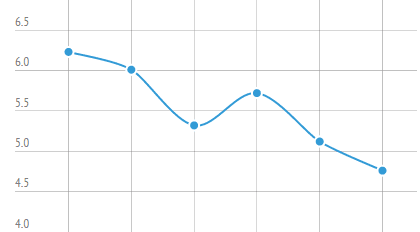

Your salary will have a big impact on the amount you can borrow for a mortgage. Lenders presume borrowers spend about 3 to 5 of their outstanding debts on servicing costs.

Pdf We Need To Have A Word Words Of Wisdom Courage And Patience For Work Home And Everywhere John R Dallas Jr Academia Edu

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments.

. How much do you need to borrow According to the Canadian Real Estate Association the average price for a house in Ontario was 940845 as of May 2022. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. For this reason our.

DTI is your minimum monthly debt divided by your gross monthly income. The maximum you could borrow from most lenders is around. Show me how it works.

In our above calculation for individuals we. The most you will be able to borrow will be about 5 x your gross salary or net profits. Our mortgage calculator can help by showing you what your monthly payments would be for particular rates of interest based on the value of the property and the size of your deposit.

Many lenders will offer a joint mortgage calculator on their website so you can work out what youre likely to be able to borrow. Bear in mind that even though a number of lenders. For example lets say the borrowers salary is 30k.

If youve already started looking for properties you can enter a property value and deposit amount into the. Its worth considering that sometimes even lenders who accept. This mortgage calculator will show how much you can afford.

Usually a joint mortgage is taken out by two people but some lenders will allow up to four people to buy together. This can be your joint income in the case of joint mortgage applications. The calculator will ask you for your income a property value and deposit amount.

The calculation shows how much lenders could let you borrow based on your income. First ARM loan options. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

Get a quick quote for how much you could. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what your monthly mortgage payments could be in under 5.

Mortgage calculator Find out how much you could borrow. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Find out how much you can borrow using our mortgage borrowing calculator simply by answering a few questions.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. If you want a more accurate quote use our affordability calculator. This mortgage calculator will show how much you can afford.

2 x 30k salary 60000. The annual payment of any loans. How Much Can I Borrow.

2

Pdf Subverting Propriety The Intimate Habitable Poetics Of Frank O Hara Kent L Boyer Phd Academia Edu

2

2

Fed Definition Financial Dictionary Fxmag Com

Uurkvccidk1q M

The Clare Echo 15 04 21 By The Clare Echo Issuu

By Order Of The Commander Air Force Recruiting Air Force Link

Low Rate Personal Loans Compare And Get The Best Deal

Pin On Thinking Of Someday The Blog

Section 138 Of Ni Act No Hard And Fast Rule That A Cheque Issued As Security Can Never Be Presented By Drawee Supreme Court Scc Blog

2

Free Promissory Note Template California Addictionary Legal Promissory Note Template Exampl Notes Template Business Notes Promissory Note

Will Real Estate Development Be A Good Career Path For The Future Quora

Vintage Leaflets And Flyers Of The 1900s Page 8 Leaflet Real Estate Ads Vintage Ads

Pdf Finacc5 ர ஜ ச கர Academia Edu

2